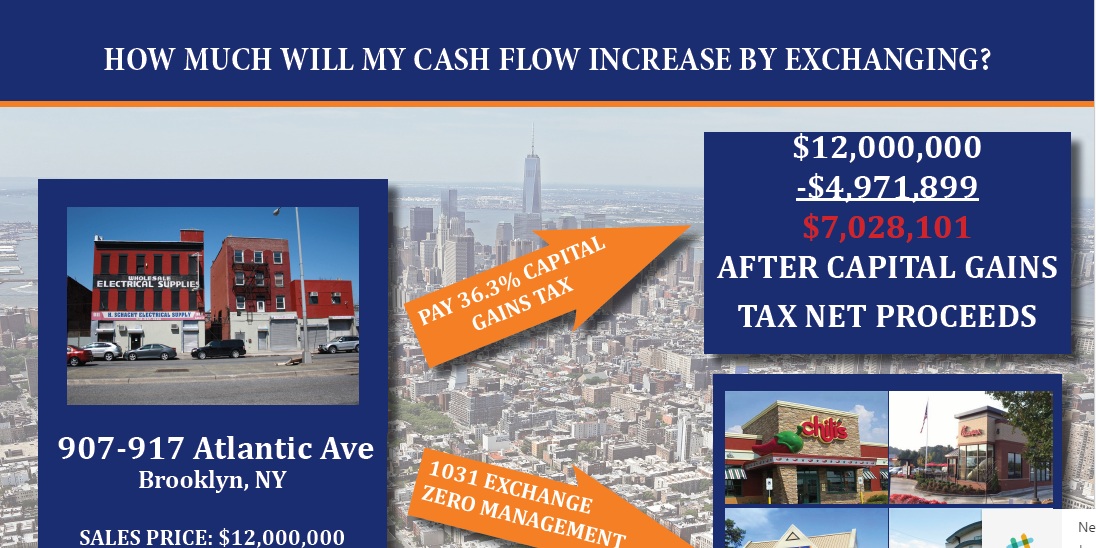

1031 Exchange

CURRENT CAP GAINS TAX – TODAY

- Capital Gain = Sale Price – Expenses – Adjusted Basis

- Federal capital gain tax rate is now 23.8% for most

- Taxpayers (up from 15% in 2012).

- New York State capital gain tax rate is 8.82%

- New York City capital gain tax rate it 3.88%

- 25% recapture tax on depreciation deductions

- Most NYC sellers will pay a total rate of around 38%

Completing a 1031 Exchange into Single Tenant NNN Retail Buildings Backed by a Corporate Guarantee allows our

Clients to…

-

Stop Managing Real Estate

-

Defer Capital Gains Tax & Invest Pre Tax Dollars

-

Secure a Passive Cash Flow by owning Real Estate

Our experience in taking an advisory role with our clients has helped us to understand the importance of knowing the tax

consequences of a sale and various reinvestment strategies. The 1031 Tax-Deferred Exchange is the most common method of

deferring or minimizing taxes when selling investment real estate. The tax code allows owners of investment properties

to defer the capital gains tax by taking some or all of the sales proceeds and reinvesting into another investment

property.

The key to preserving the millions of dollars you have earned with your investment property is to make sure that the

sale and purchases are structured correctly. It is important to have a clear idea of what type of property you would

like to purchase in a 1031 Exchange before attempting to sell. In most 1031 Exchanges that we help our clients

facilitate, they have a property picked out before or just after they close on their property. This allows for a closing

to occur on the property they are purchasing in the first 60 days of the 1031 Exchange Timeline.

Click Here to view the 1031 Tax-Deferred Exchange Timeline

Single Tenant NNN Retail Properties

Single tenant NNN properties continue to be a popular option in a 1031 Exchange. They offer the ability to purchase a

property with no management obligation where the tenant is responsible for paying all expenses associated with the

property and maintaining the building. There are many different types of net leased properties available; medical,

office, industrial and retail. The most in demand and common are national, publicly traded retail companies who offer a

corporate guarantee with a long lease.

Click Here for examples of Single Tenant NNN Retail Properties Sales

Interested in reinvesting into an apartment, mixed use, retail, office building, or development site locally?

Please contact Matt Fotis directly Tel 212-430-5234 or Matthew.Fotis@marcusmillichap.com